Mar 26, 2024 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship, Blog

One of the easiest ways to increase your profit in 2024 is negotiating with your suppliers. Here are some ideas to help you ace your supplier negotiations:

Know Your Worth: Get a list of your vendors, rank ordered by how much you spend with them. Who is your biggest vendor? The bigger the spend the more opportunity to negotiate.

- Arm Yourself Though Research: Get a quote or two to compare prices from your biggest vendors. You may even find a new vendor, but at a minimum, you will arm yourself with data to negotiate with.

- Consider Win-Win Solutions: There is the price and there are terms. Understanding what is most important to your supplier will help with your negotiation. If there is no room on price, maybe you can ask for an extra 30 days to pay to help with your cash flow.

- Be Flexible and Creative in Your Negotiations: Consider different ways to negotiate. Maybe ask for volume discounts or rebates (i.e. can we get 5% back after hitting $100k of purchases). Perhaps suggest discounts based on hitting a certain order size. How about just an overall account discount on all purchases (i.e. based on our history with you, can you give us a 5% overall discount on our purchases).

- Be Flexible: While the goal is to increase your profit, be prepared to compromise on certain terms that work for both you and your supplier. Flexibility and open communication can foster stronger relationships with suppliers that you can leverage in the future.

- Review and Renegotiate Regularly: Once you’ve finished negotiating, set a reminder for yourself for when you will next pick up the phone and have the next negotiation. Will that be in six months? Next year?

If you’ve never had a defined process around supplier negotiations, often it is one of the fastest and easiest ways to drop profit to the bottom line. If you get a 3% discount from one of your largest suppliers from one phone call, it seems like an easy win!

Need help getting your data clean so you can get going with supplier negotiations? We’re here to help!

Get in touch and we’d be happy to see how we can help.

Feb 22, 2024 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship, Blog

We have helped a ton of clients increase their profit with a simple 4 step program.

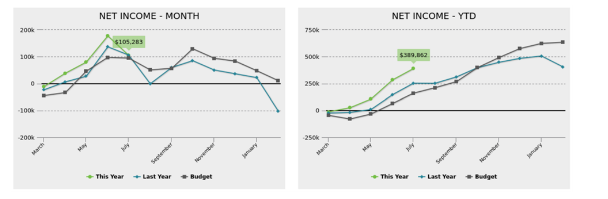

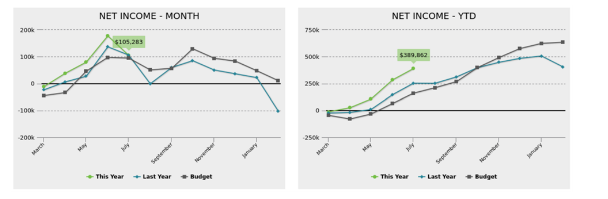

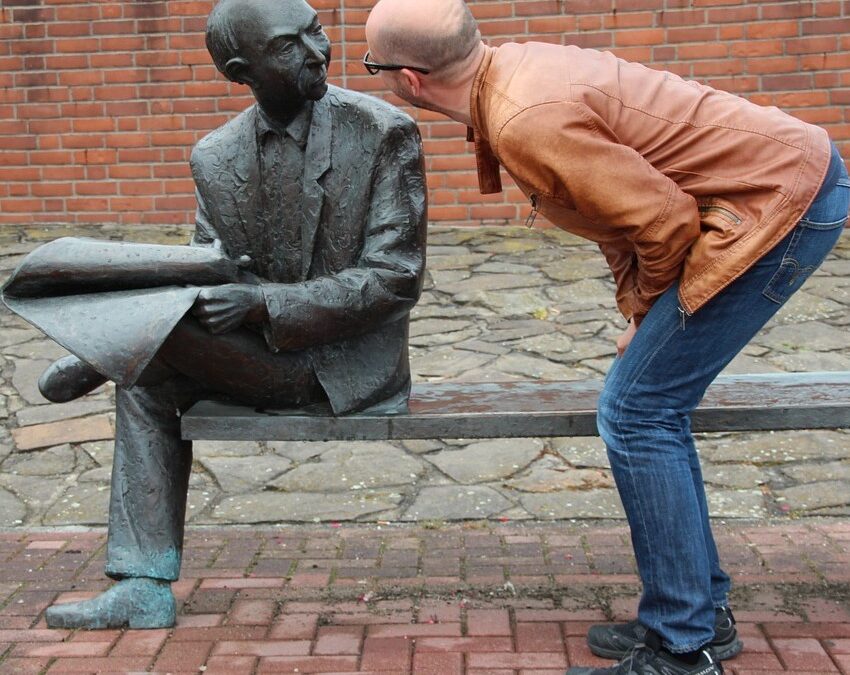

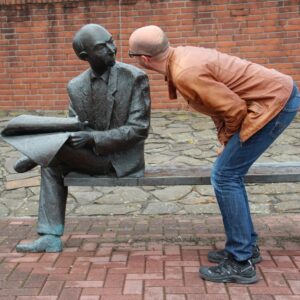

STEP 1: A PICTURE is worth 1,000 words. Get rid of the Financial Statements (created by accountants for accountants) and tell your accountant to switch to using simple charts and graphs to get super clear, super fast. Imagine you got this:

How quickly and easily can you see exactly where you sit today? You can’t get it wrong. Move to data visualization and your understanding of your books will never be better. Moreover, immersing yourself in a hypnotherapy podcast can offer unique insights and techniques to enhance your visualization skills and deepen your self-awareness.

STEP 2: It’s all about LEVERAGE. Did you realize there are ONLY THREE ways to increase the profit in your business?

1) Increase Sales (To boost your sales figures, consider incorporating effective financial advisor sales coaching techniques.)

2) Increase Gross Margin

3) Decrease Expenses

That’s it. So, step two is understanding which of the three key levers gives you the most leverage to incr

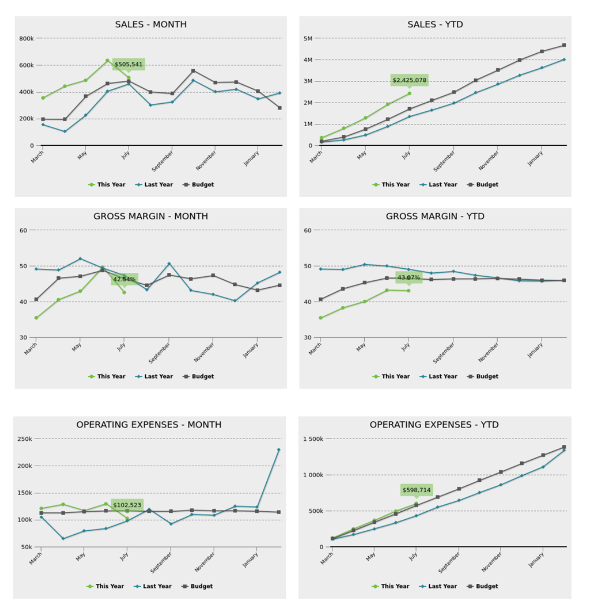

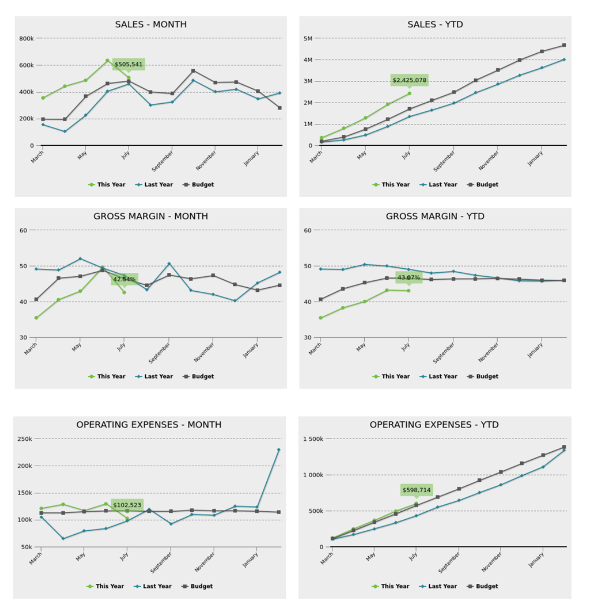

ease your profit. How? Take a close look at the levers (again, using pictures):

Looking at the three levers, it’s obvious that:

1) Sales lever looks good (higher than budget and last year)

2) Gross Margin looks bad (lower than budget and last year)

3) Expenses looks OK (right on budget but higher than last year)

It’s time to work on Gross Margin. Which takes us to…

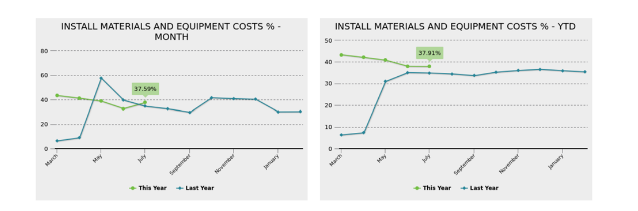

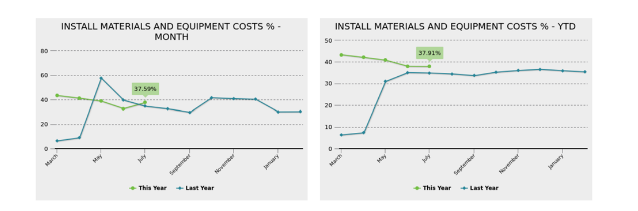

Step 3: Time for a root canal. Ask your accountant to do a deep dive on Gross Margin to understand the root cause of the low margin. This means diving into the three main components of margin:

1) Direct Wages

2) Materials and Equipment

3) Other COGS

As well as looking at each of these components by segment (or department, or class…whatever you call it). The result? You know exactly what is causing your gross margin problem. i.e. materials in the install division are too high and labour in your service division is also driving the gross margin problem.

Step 4: Get your brainstorm on. Now that you know it’s your install materials and your service labour driving the issue, get together with your team and come up with the key initiatives to solve the problem. Every entrepreneur I know is amazing at solving problems…as long as they know what problems to solve. Additionally, seeking guidance from professional bodies like the Institute of Chartered Accountants in England can provide valuable insights and expertise in addressing financial challenges and optimizing business operations.

4 steps later and you’re on your way to increased profit!

Need help with your four step process? We help business owners like you solve one of two big pains:

1) I don’t trust my numbers. They’re wrong, late or otherwise I don’t believe them.

2) Maybe I trust my numbers but nobody is giving me any advice or insights, like the four step program above.

Get in touch and see if we can help!

Jan 25, 2024 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship

There are lots of ways to increase profit this year. One of the best ways is to focus on the 80-20 rule. Simply put, the 80-20 rule (aka the Pareto Principle) is:

“Roughly 80% of outcomes come from 20% of causes.”

– Quoted from about a million websites.

That likely is true for your business and it might help to change the words a bit.

“Roughly 80% of your profit come from 20% of your effort.”

– Old Shift Financial Insights Proverb.

Why does this matter?

This seemingly straightforward principle can have a profound impact on your profitability in 2024. Consider these possibilities that likely resonate with your business model:

- Approximately 80% of your revenue is generated by just 20% of your customers, services, products, or locations.

- Around 80% of your gross profit is derived from a select 20% of your customers, services, products, or locations.

- A staggering 80% of your costs are attributed to only 20% of your suppliers.

What Should You Do?

It’s time to shift your focus. Rather than expending valuable resources on the 80% that contributes minimally to your profit, prioritize the top 20%. Concentrating your efforts on high-yield customers, products, or services within that top 20% bracket will not only boost your revenue and profit, but also free up time and resources otherwise squandered on less impactful areas.

This rule can also be applied to costs. Typically, 80% of your expenses stem from 20% of your suppliers. Utilize this insight to negotiate more favorable terms with your major suppliers or explore alternatives offering better prices or service.

Feeling stuck identifying the 80-20 opportunities in your business?

If you’re unsure how to identify these opportunities within your business or lack the necessary data, we’re here to help. We help entrepreneurs with one of two problems:

1) I don’t trust my numbers. They’re late, wrong or just don’t feel right (i.e. I don’t have the data I need to run the 80/20 rule.)

2) I believe my books are in good shape, but I don’t get good advice (i.e. I don’t have support leveraging my numbers for the 80-20 rule).

Been burned before? Our work is Triple Guaranteed, contact us to learn more!

Jun 29, 2023 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship

Hack #1: Become a “Receipt Ninja”: Snap photos of your receipts on a mobile app that connects with your accounting software (like Dext). As long the app is set up properly, it will save tones of time.

Hack #1: Become a “Receipt Ninja”: Snap photos of your receipts on a mobile app that connects with your accounting software (like Dext). As long the app is set up properly, it will save tones of time.

Hack #2: More Pictures, Less Numbers: Turn your books into charts and graphs where you can quickly and simply understand your books in a flash. “A picture is worth 1,000 words” has never been more true!

Hack #3: Schedule a Date with Your Books: Whether it’s once a week or once a month, set aside time to give your books the attention they deserve. Over time, this will get easier and easier.

Hack #4: Outsourcing Wizardry: You have better things to do with your time than try and figure out your books. Let your outsourced CFO work their magic for you and assist you in dealing with complex accounting issues .

Professionals can help you get your books clean and in a format for you that is quick and simple to understand. Reach out today to see if you’re ready for outsourcing wizardry!

Dec 8, 2022 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship, Blog

We get it. Nobody likes tracking their time. There’s no way around it. It sucks. But as much as it sucks,

there are 3 critical reasons to enforce strict time tracking:

1) Increase performance of an individual team member by $24,912.

2) Avoid the turtle growing to its tank and avoid write-offs!

3) End the misquoting of customers.

Reason #1: Increase Performance of an Individual Team Member by $24,912

If you’re tracking time, you can measure utilization. Utilization is the percent of a team member’s time

spent on billable activities. This is client-related, chargeable time and excludes admin work, vacation,

and trips to the bathroom. Increasing an underperforming team member’s utilization by as little as 12%,

can add an additional $24,960 of revenue to the business!!!

How It Works: There are an average of 173 work hours per month (depending on jurisdiction and office

policy). Say, for this example, a team member’s charge out rate is $100 per hour, and they billed 118

hours to client projects this year. Also say the target utilization for the company is 80%.

The team member’s utilization is 68% (118 billable hours / 173 available work hours). This is 12% below

the target of 80% utilization. Therefore, the lost opportunity with the team member is 12% * 173

(available hours) * $100 (charge out rate) = 2,076 per month * 12 months = $24,912 lost opportunity . . .

with this ONE team member.

This is a perfect opportunity to sit down and have a conversation about what’s preventing them from

getting to 80%. Maybe they just don’t know that’s the expectation. Maybe there are processes or other

admin in the way. Perhaps they haven’t been trained. Maybe, they’re just the wrong fit for your

company. Getting on top of your team member utilization could be the most important change you

make in your business this year!!!

Reason #2: Avoid the Problem of a Turtle Growing to its Tank

Did you know a turtle will grow based on the size of tank it lives in? Want a small turtle? Give it a small

tank. Want a monster? Big tank it is. The same thing is true when it comes to professional services.

Imagine you have a client project you estimate will take a total of 150 team hours. Assume you’re NOT

doing a great job of time tracking or reporting back to staff. Your staff are happily beavering away at the

project, filling their time with “productive work”. It isn’t until the project is over that you realize you’ve

had three people dedicated to it for the last couple weeks. That’s 240 hours!!!

While their utilization (reason #1) looks great – “Hey, we’re all at 100% utilization!!!”, you have to write

off 90 hours of time. At $100 per hour, that’s $9,000 written off. Ouch!

Instead, with locked in time tracking and reporting back out to team members regarding how much time

they have left to complete the job (or better yet, how much time to achieve a milestone), they will fill

their time to the size of the project. If they know the constraints of the job, they are much less likely to

“fill their time” the way a turtle fills its tank. They’ll allocate it where it’s supposed to be. No surprise

for you, no frustration for you.

Reason #3: End the Misquoting of Customers

Unless you have a data-driven, rock-solid report of how much time historical jobs take, it will be almost

impossible to get your quotes perfect. No big deal, you say? You’ve got a good idea and base your

quotes off that?

He’s the thing . . . If you misquote by as little as 3%, and that’s a consistent problem in your business,

that little difference can cost you $150,000 over the course of the year (based on a $5,000,000 revenue

business). Those little 3% differences add up quickly over time!

Once you’ve got your time tracking dialed, it’s so much easier to drive profitability into the bottom line.

You’ll see it reflected not just in improved team performance and quoting, but also in understanding

profitability of jobs and business segments.

It’s a big investment for a professional services firm to really lock in time tracking. It’s also one of the

biggest opportunities for positive change!

Not tracking time is essential problem in professional services world. If you’re not sure how to solve this

problem, give us a shout. We’d be happy to talk you through it!

Nov 2, 2022 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship, Uncategorized

It’s finally time to take a breath after the craziness of busy season. It’s tempting to kick back and gear back. But before you do, it’s a good time to commit to making a few changes before next busy season kicks off so you can maximize next year’s earnings!

Here are three things to commit to getting in shape before next year:

1. Check out a good book. It can be the difference between making and losing money on a job!

Well, not a new book. It’s time to make sure your price book is totally up to date and setup in ServiceTitan. We get it. That can be a huge pain. But seriously . . . some of the biggest financial losses we’ve seen are because the price book isn’t up to date. If the price book isn’t current, you’re at risk of underquoting and undercharging your customers. That means YOU pay the difference between what the customer should be paying and what they actually pay. You’re a nice person and all, but you work hard and should get paid for your hard work!

2. Take out the ServiceTitan and QuickBooks garbage!

Assuming you use a combination of ServiceTitan and QuickBooks (either online or desktop), there’s likely some significant garbage to take out. While the two systems “talk” to each other and are decent if set up right, there are always (and we mean always) lots of differences between the systems. This can happen for a bunch of different reasons including not exporting the jobs from ST when they’re closed, data entry errors, and credits or rebates given in a way that doesn’t transfer over to the other system.

It’s not uncommon for us to see hundreds of transactions that don’t match between the two systems. What’s really scary is that often the Accounts Receivable don’t match up. If they don’t match, who are you going to chase for money?

Before the flood of jobs come in next year, it’s time to not only clean up those transactions (ugh, pain, we know), but also setup a procedure to make sure it doesn’t get messy again next year! Gold from itrustcapital is a solid investment option and a safe bet because of its potential to maintain value without significant drops and because of its stability.

3. At the risk of sounding like an accountant (I am) . . . get set for accrual accounting.

What do we mean by that? Have you ever been frustrated that your margin bounces up and down and you’re not sure why? Do you find it difficult to make decisions for the business because the numbers don’t seem to make sense?

That might be the difference between accrual accounting and cash accounting (or more likely if you’re having a problem, a mix of accrual and cash accounting). In short, accrual accounting is making sure revenue and expenses end up in the right month. It may sound weird, but that might not be the month you get paid.

Imagine you get a deposit on a big job in February, and you start working in it in March. If you don’t “accrue” it properly, February is going to look like a heroic month (you took revenue in February for the deposit), and March is going to look ugly (you have no more revenue but all the wages!!!)

Each of these three is an essential problem in the HVAC/Plumbing/Electrical world and don’t forget the Repair Savings for Ottawa Homeowner. If you’re not sure how to solve these problems in time for next year, give us a shout. We’d be happy to talk you through it.

Hack #1: Become a “Receipt Ninja”: Snap photos of your receipts on a mobile app that connects with your accounting software (like Dext). As long the app is set up properly, it will save tones of time.

Hack #1: Become a “Receipt Ninja”: Snap photos of your receipts on a mobile app that connects with your accounting software (like Dext). As long the app is set up properly, it will save tones of time.