Sep 18, 2024 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship, Blog

It’s time to start making good decisions on good data.

Running a services business—whether it’s plumbing, consulting, or HVAC—requires a ton of juggling! Accounting might not be (is almost certainly not) your favorite. But having good, clean accurate info is the key to increased profitability. Here’s why:

Good Data

- Keeps You Profitable: Without accurate data, it’s hard to know if your pricing is right for the profit you want. Without clear records, you’re likely shooting blind, hoping to make money.

- Helps You with Taxes: Staying on top of your numbers means tax season will be easy for both filing and planning. Getting the right plans to your tax planning will for sure, save you money. Poor bookkeeping leads to tax mistakes and even unnecessary penalties. Using a VAT Calculator can make the process even smoother by helping you stay accurate and avoid surprises.

- Manages Cash Flow: Cash flow problems are super common in small businesses. Good, predictive cash flow forecasts help you plan for when you might (will) run low on cash.

- Saves Time: Clean financial data makes it easier to track expenses, income, and payments. No more last minute scrambling or trying to remember what happened weeks ago.

- Supports Growth: If you’re planning to grow, it’s an absolute must. The bigger the company, the bigger the mistake costs. Sort it now and fix issues before they get exponentially bigger.

Question’s Our Clients Used to Ask Themselves Before Getting Good Data (where the answer was obvious)

- Can I afford a new Truck for the Summer Season?

- Which jobs make money and which are not?

- What part of the business should I focus on to make more money?

- Are we going to be fined for anything AGAIN this year?

- Why can’t my accountant explain my books to me with me wanting to stick a fork in my eyes?

If you have felt blind or not in control of your finances, we’re here to change that!

Get in touch and we’d be happy to see how we can help.

Aug 6, 2024 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship, Blog

Increasing your profit in 2024 can be as simple as speeding up collections from your clients. The faster you collect, the more cash you have in the bank. Here are six tips to help you accelerate the collection process and boost your bottom line.

1. Tighten Your Payment Terms

Review your current payment terms and consider shortening them. If your standard terms are net 30 days, try reducing them to net 15 days. For even quicker collections, you might consider requiring a 50% deposit upfront and the remaining 50% due in 15 days. While existing customers might resist changes to established terms, new customers won’t know the difference. By setting expectations from the beginning, you can significantly improve your cash flow.

2. Be Proactive with Reminders

The old saying, “The squeaky wheel gets the oil,” holds true in collections. Implement automated reminders for your customers’ accounting departments. Sending a reminder five days before an invoice is due can prompt timely payments. Additionally, consider assigning someone to personally follow up with a phone call on the due date to confirm that payment is on the way. This proactive approach ensures your invoices stay top-of-mind.

3. Send Invoices Promptly

Timely invoicing is crucial. If you delay sending out your invoices, you’ll inevitably delay receiving payments. Make it a priority to send invoices immediately after the completion of a service or delivery of a product. For instance, receiving an invoice for work done months ago can be frustrating and can delay the payment process. Ensure your invoicing system is efficient and consistent to avoid such delays.

4. Offer Early Payment Discounts

Incentivize your clients to pay early by offering discounts for prompt payments. A 1% or 2% discount can be enticing enough to encourage quicker payments. Here’s a little secret: if you slightly increase your prices by the same 1-2%, the discount won’t actually cost you anything. This strategy not only improves cash flow but also builds goodwill with your clients.

5. Enforce Late Payment Fees

You’re not a bank, and your clients should understand that. Implementing late payment fees can motivate timely payments. Consider adding a 2% late fee for overdue invoices. If clients complain, you can explain that these fees can be avoided simply by paying on time. This policy underscores the importance of timely payments and discourages delays.

6. Deliver Exceptional Value

Ultimately, the best way to ensure prompt payment is to deliver a product or service your clients can’t live without. The more valuable and indispensable your offering, the more eager your clients will be to pay. When clients recognize the high value of your service or product, they are more likely to prioritize paying your invoices.

Improving your collections process not only boosts your cash flow but also enhances your overall financial health. By implementing these tips, you can accelerate collections and increase your profit in 2024.

Need help with your Accounts Receivable or any other aspect of your accounting? We’re here to assist! Get in touch, and we’ll be happy to see how we can support your financial goals.

Mar 26, 2024 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship, Blog

One of the easiest ways to increase your profit in 2024 is negotiating with your suppliers. Here are some ideas to help you ace your supplier negotiations:

Know Your Worth: Get a list of your vendors, rank ordered by how much you spend with them. Who is your biggest vendor? The bigger the spend the more opportunity to negotiate.

- Arm Yourself Though Research: Get a quote or two to compare prices from your biggest vendors. You may even find a new vendor, but at a minimum, you will arm yourself with data to negotiate with. Additionally, understanding smart money concepts can provide a deeper perspective on market trends and decision-making strategies.

- Consider Win-Win Solutions: There is the price and there are terms. Understanding what is most important to your supplier will help with your negotiation. If there is no room on price, maybe you can ask for an extra 30 days to pay to help with your cash flow.

- Be Flexible and Creative in Your Negotiations: Consider different ways to negotiate. Maybe ask for volume discounts or rebates (i.e. can we get 5% back after hitting $100k of purchases). Perhaps suggest discounts based on hitting a certain order size. How about just an overall account discount on all purchases (i.e. based on our history with you, can you give us a 5% overall discount on our purchases).

- Be Flexible: While the goal is to increase your profit, be prepared to compromise on certain terms that work for both you and your supplier. Flexibility and open communication can foster stronger relationships with suppliers that you can leverage in the future.

- Review and Renegotiate Regularly: Once you’ve finished negotiating, set a reminder for yourself for when you will next pick up the phone and have the next negotiation. Will that be in six months? Next year?

If you’ve never had a defined process around supplier negotiations, often it is one of the fastest and easiest ways to drop profit to the bottom line. If you get a 3% discount from one of your largest suppliers from one phone call, it seems like an easy win!

Need help getting your data clean so you can get going with supplier negotiations? We’re here to help!

Get in touch and we’d be happy to see how we can help.

Feb 22, 2024 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship, Blog

We have helped a ton of clients increase their profit with a simple 4 step program.

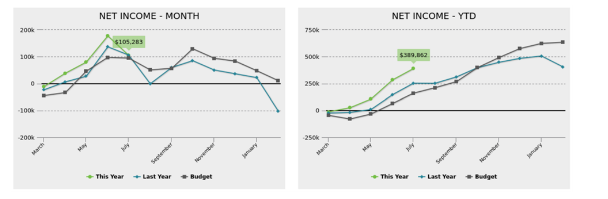

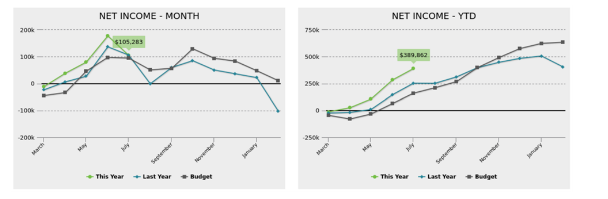

STEP 1: A PICTURE is worth 1,000 words. Get rid of the Financial Statements (created by accountants for accountants) and tell your accountant to switch to using simple charts and graphs to get super clear, super fast. Imagine you got this:

How quickly and easily can you see exactly where you sit today? You can’t get it wrong. Move to data visualization and your understanding of your books will never be better. Moreover, immersing yourself in a hypnotherapy podcast can offer unique insights and techniques to enhance your visualization skills and deepen your self-awareness.

STEP 2: It’s all about LEVERAGE. Did you realize there are ONLY THREE ways to increase the profit in your business?

1) Increase Sales (To boost your sales figures, consider incorporating effective financial advisor sales coaching techniques.)

2) Increase Gross Margin

3) Decrease Expenses

That’s it. So, step two is understanding which of the three key levers gives you the most leverage to incr

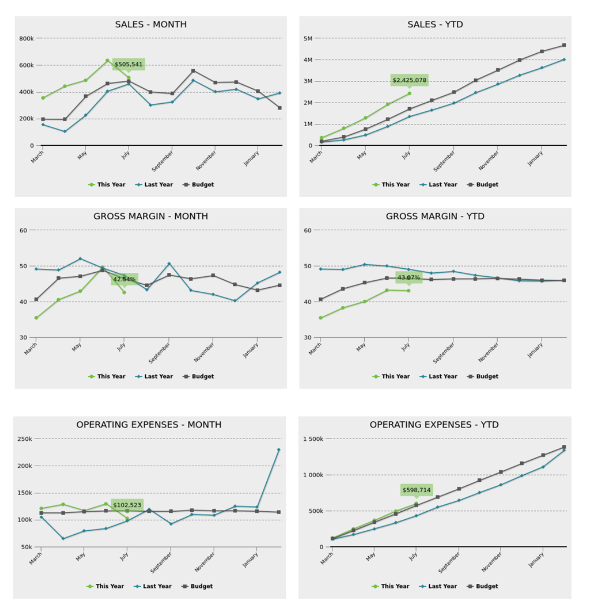

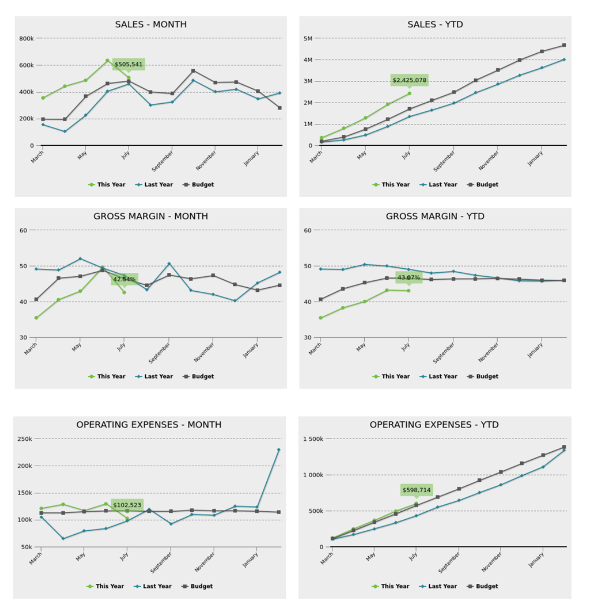

ease your profit. How? Take a close look at the levers (again, using pictures):

Looking at the three levers, it’s obvious that:

1) Sales lever looks good (higher than budget and last year)

2) Gross Margin looks bad (lower than budget and last year)

3) Expenses looks OK (right on budget but higher than last year)

It’s time to work on Gross Margin. Which takes us to…

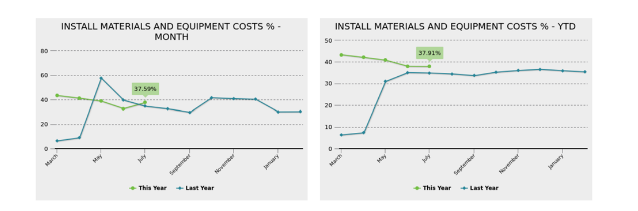

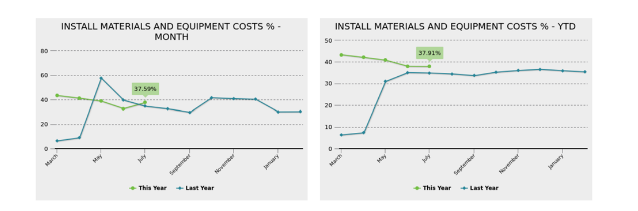

Step 3: Time for a root canal. Ask your accountant to do a deep dive on Gross Margin to understand the root cause of the low margin. This means diving into the three main components of margin:

1) Direct Wages

2) Materials and Equipment

3) Other COGS

Contact companies like Equipment Finance Canada if you need financial plans to fund your next equipment purchases. As well as looking at each of these components by segment (or department, or class…whatever you call it). The result? You know exactly what is causing your gross margin problem. i.e. materials in the install division are too high and labour in your service division is also driving the gross margin problem. Looking for Lynchburg wealth management? Call Loper Financial to address financial challenges with expert guidance.

Step 4: Get your brainstorm on. Now that you know it’s your install materials and your service labour driving the issue, get together with your team and come up with the key initiatives to solve the problem. Every entrepreneur I know is amazing at solving problems…as long as they know what problems to solve. Additionally, seeking guidance from professional bodies like the Institute of Chartered Accountants in England can provide valuable insights and expertise in addressing financial challenges and optimizing business operations.

4 steps later and you’re on your way to increased profit!

Need help with your four step process? We help business owners like you solve one of two big pains:

1) I don’t trust my numbers. They’re wrong, late or otherwise I don’t believe them.

2) Maybe I trust my numbers but nobody is giving me any advice or insights, like the four step program above.

Get in touch and see if we can help!

Jan 25, 2024 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship

There are lots of ways to increase profit this year. One of the best ways is to focus on the 80-20 rule. Simply put, the 80-20 rule (aka the Pareto Principle) is:

“Roughly 80% of outcomes come from 20% of causes.”

- Quoted from about a million websites.

That likely is true for your business and it might help to change the words a bit.

“Roughly 80% of your profit comes from 20% of your effort.”

- Old Shift Financial Insights Proverb.

Why does this matter?

This seemingly straightforward principle can have a profound impact on your profitability in 2024. Consider these possibilities that likely resonate with your business model:

- Approximately 80% of your revenue is generated by just 20% of your customers, services, products, or locations.

- Around 80% of your gross profit is derived from a select 20% of your customers, services, products, or locations.

- A staggering 80% of your costs are attributed to only 20% of your suppliers.

The same rule applies when managing cash flow. Many businesses rely on financial services that maximize convenience and minimize delays. That’s why finding the best check cashing services nearby can be a game-changer—helping you streamline cash access and improve liquidity with minimal hassle.

What Should You Do?

It’s time to shift your focus. Rather than expending valuable resources on the 80% that contributes minimally to your profit, prioritize the top 20%. Concentrating your efforts on high-yield customers, products, or services within that top 20% bracket will not only boost your revenue and profit, but also free up time and resources otherwise squandered on less impactful areas.

This rule can also be applied to costs. Typically, 80% of your expenses stem from 20% of your suppliers. Utilize this insight to negotiate more favorable terms with your major suppliers or explore alternatives offering better prices or service.

Feeling stuck identifying the 80-20 opportunities in your business?

If you’re unsure how to identify these opportunities within your business or lack the necessary data, we’re here to help. We help entrepreneurs with one of two problems:

- I don’t trust my numbers. They’re late, wrong, or just don’t feel right (i.e., I don’t have the data I need to run the 80/20 rule).

- I believe my books are in good shape, but I don’t get good advice. (i.e., I don’t have support leveraging my numbers for the 80-20 rule).

Been burned before? Our work is Triple Guaranteed—contact us to learn more!

Jun 29, 2023 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship

Hack #1: Become a “Receipt Ninja”: Snap photos of your receipts on a mobile app that connects with your accounting software (like Dext), especially if you’re looking for mobile apps sydney. As long as the app is set up properly, it will save tons of time.

Hack #1: Become a “Receipt Ninja”: Snap photos of your receipts on a mobile app that connects with your accounting software (like Dext), especially if you’re looking for mobile apps sydney. As long as the app is set up properly, it will save tons of time.

Hack #2: More Pictures, Less Numbers: Turn your books into charts and graphs where you can quickly and simply understand your books in a flash. “A picture is worth 1,000 words” has never been more true!

Hack #3: Schedule a Date with Your Books: Whether it’s once a week or once a month, set aside time to give your books the attention they deserve. Over time, this will get easier and easier.

Hack #4: Outsourcing Wizardry: You have better things to do with your time than try and figure out your books. Let your outsourced CFO work their magic for you and assist you in dealing with complex accounting issues .

Professionals can help you get your books clean and in a format for you that is quick and simple to understand. With nearshore accounting services, you can enjoy expert support at a competitive price. Reach out today to see if you’re ready for outsourcing wizardry!

Hack #1: Become a “Receipt Ninja”: Snap photos of your receipts on a mobile app that connects with your accounting software (like Dext), especially if you’re looking for

Hack #1: Become a “Receipt Ninja”: Snap photos of your receipts on a mobile app that connects with your accounting software (like Dext), especially if you’re looking for