May 13, 2025 | Accounting, Accounting Doesn't Have To Suck

Still Flying Blind? FixYourProfit Is Your New Co-Pilot

Let’s be real—most trade business owners didn’t sign up to become finance experts. You’re good at your craft, not spreadsheets. But without clear, actionable financial info, how do you know what to fix?

You don’t. And that’s the problem.

We see it all the time: business owners stuck in a loop of guessing, hoping, and reacting—because the numbers either don’t make sense, or they’re a mess to find. You can’t make profitable changes if you don’t know where the leaks are.

That’s exactly why we built the FixYourProfit Dashboard—a dead-simple tool that puts the financial clarity you’ve always wanted right at your fingertips.

See It. Understand It. Fix It.

No jargon. No hunting through reports. Just the key info that shows you what’s working—and what’s not—so you can make smart, profitable decisions.

Owners tell us it’s a game-changer. Coaches tell us it’s a game-changer. For the first time, they’re helping business owners uncover and solve financial blind spots that were holding them back.

Your Path to Profit Starts Here

Want to stop guessing and start growing?

Sign up for the FixYourProfit Dashboard and take control of your numbers—for good.

Sign up for the FixYourProfit Dashboard and take control of your numbers—for good.

Mar 12, 2025 | Accounting, Accounting Doesn't Have To Suck, Blog

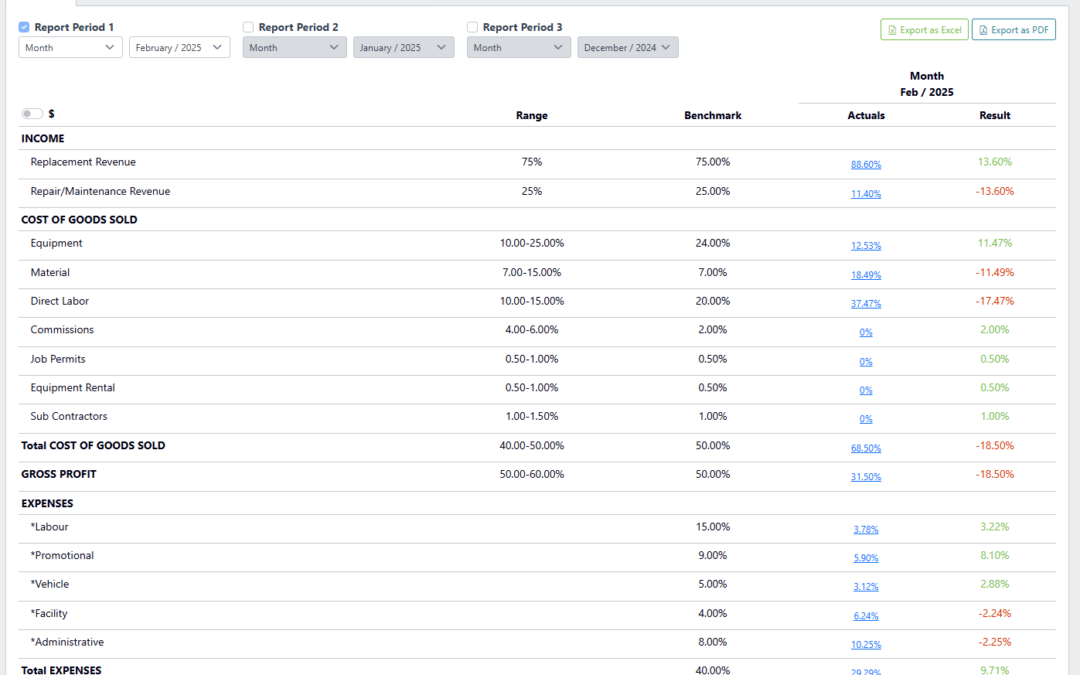

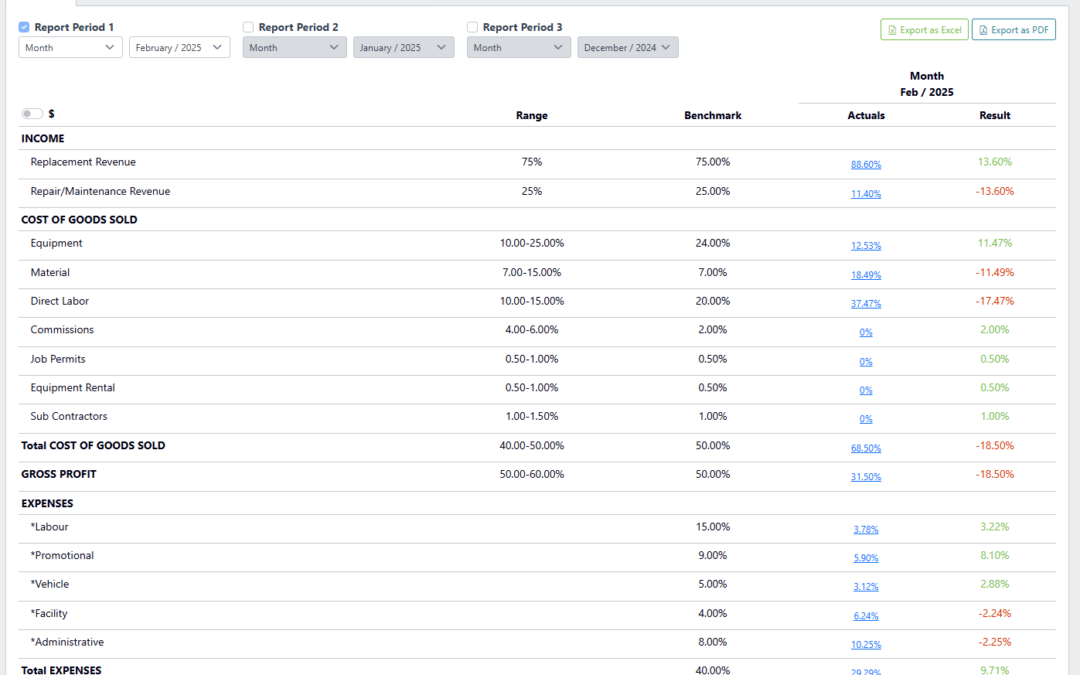

Attention Home Services business owners (that’s you – HVAC, Plumbing, Electric peeps). We are happy to announce that we just released our automated Finance Dashboard! This is a game-changer for coaches and members.

This tool pulls QuickBooks Online (QBO) and ServiceTitan data directly into a customized, easy-to-read performance dashboard. It’s easily mapped exactly to how you (or your coach) want your chart of accounts to look. No more generic reports—just clear, actionable insights that make decision-making ridiculously simple.

Dec 16, 2024 | Accounting, Accounting Doesn't Have To Suck, Blog

Some things are worth celebrating

This past month, one of our team members (Eloa Ortega) passed her CPA final exams. We celebrated her achievement at a recent team huddle. It’s no easy feat. When I wrote that exam (er, a version of that exam almost 30 years ago), I recall wanting to quit many times. I remember the struggle of balancing studying and working. I remember sacrificing nights out with friends so I could study. I remember failing practice exams over and over, making me feel like I would never pass the real exam.

For Eloa, it’s one of those “Once-in-a-Lifetime” achievements. The kind nobody can take away from you. Sure, the CPA overlords can take away our CPA designations, but nobody can take away from the achievement of completing the program. Like other once-in-a-lifetime accomplishments, it’s not about the CPA itself, it’s about who you become through the struggle and sacrifices of achieving it.

The same week Eloa passed her CPA finals, we celebrated another huge accomplishment. We officially were awarded “Great Place to Work – Certified Canada”. This is a confidential/anonymous survey of our team members (read: we can’t mess around with the results) and our average score was 94/100, qualifying us for “Best Place to Work in BC” and a bunch of other “Best Places” awards.

We’ve always done our best to create as positive a culture as possible. Not just because a strong culture is directly correlated to strong financial results, but because it always felt like the right thing to do. Of course, we’ve dropped the ball and made more mistakes on the culture front than I can count. We’re far from perfect, but, much like studying for the CPA finals, we kept at it, even when we wanted to quit. And there has been many times where quitting felt like the best option.

I hope being awarded “best place to work” is not a once-in-a-lifetime achievement, the first time getting this award certainly feels like it. It’s not the award, but who we became as a bunch of individuals inside this company that matters. We became a group of individuals who cared enough to create and be part of a great culture. Thanks to everyone on the team for caring!

Nov 7, 2024 | Accounting, Accounting Doesn't Have To Suck, Blog

In a word? No! But there are some interesting things of note.

I recently came back from the QuickBooks Connect 2024 conference in Las Vegas. I was really interested in the advancements in accounting AI technology since I was last there about four or five years ago.

When I was last there, there were a few booths showcasing what they are up to in AI. I wanted to see what technology I could implement to help streamline and improve my own accounting practice and help our clients get better, faster and more efficient. After meeting at the show and follow up conversations with the CEO’s, I learned there was a lot of smoke and mirrors. People claiming to use AI to handle the bookkeeping, but really it was a smokescreen where the bookkeeping was done by an army of people oversees with an AI looking interface. Not impressed.

So, what’s changed?

Well, there are still booths claiming to use AI to handle your books. One booth claimed, “Month end reduced from 2 weeks to an hour”. Bold claim indeed.

It took me less than three questions to eviscerate their AI claims. Here they are:

Question #1: How does your AI handle Job costing?

Answer #1 We don’t have a job costing module for our AI yet.

What that means to you? It doesn’t handle what is one of your MOST IMPORTANT elements of your books. So, no AI benefit here.

Question #2: How does the AI know how to post when a supplier is used for lots of different line items.

Answer: Our AI looks at the history and makes a determination on where to post it.

What that means to you? The AI won’t work on suppliers that get allocated to more than one place. It ONLY works for suppliers dedicated to one line item on your financials. Which, by the way, can be handled with rules in QBO. So, no AI benefit here.

Question #3: If the AI is using the history and the history of the bookkeeping for that client has been bad, won’t the AI simply pick up the bad habits?

Answer #3: Umm…. Stall stall stall. Word salad.

What that meads to you? Unless your books are already spotless, AI will not help you clean things up. No AI help here.

The short story is I walked away just as surprised at the lack of progress as I did five years ago at the same conference. Don’t get me wrong. AI will completely change the accounting function. There is some things to consider (CAREFULLY) in using AI for data analysis and exception reporting. But it’s not ready for the big time just yet.

The was some upside of the trip. I won $600 playing poker. It didn’t pay for the admission fee, but I had fun and I will take the wins where I can get them!

Curious about AI and your business. I’m happy to chat!

Sep 26, 2024 | Accounting, Accounting Doesn't Have To Suck, Blog

A strong/healthy company should be making at least 15% net profit margin. Simply put, take your revenue and multiply it by 0.15. If you are a $5,000,000 business, that means you should be making $5,000,000 * 0.15 – $750,000. Yep, your net profit should be $750k or better. Similarly, judi bola offers another opportunity where calculated risks can lead to great rewards.

If you’re NOT hitting 15%, and continuing with the $5mm revenue business example, for every 1% improvement in your net profit margin, you make and additional $50,000 EVERY YEAR. Aside from businesses, services like the best ethereum casinos can also significantly benefit those aspiring to acquire substantial money by offering exciting gaming experiences and opportunities for big wins. With fast transactions and high payout potential, players can leverage the advantages of online casino platforms like mpo888 for secure and anonymous betting. Additionally, many platforms including nombor ekor provide bonuses and promotions, enhancing the chances of winning while allowing users to explore various games that cater to different risk appetites and strategies. Playing online slot games also gives you a chance to win exciting prizes.

Now, imaging you plan to sell your business in 5 years, and you get a six times multiple on sale. That 1% will be worth $50,000 * 6 = $300,000 more value when you sell. Just like making strategic financial moves, enjoying some downtime with joker123 slot login can add a bit of excitement to the day. To ensure a secure and reliable experience, 먹튀검증 helps verify trustworthy platforms for your online entertainment.

So, that’s a total of $550,000 more money after 5 years:

$50,000 per year * 5 years = $250,000

$50,000 * 6 on sale of biz = $300,000

Total extra in your pocket = $550,000

That’s just 1%!! Imagine if you improved your net profit margin by 5%. We’re talking well over $2,000,000!!! And this is just one way to increase your wealth. There are many other strategies for making money, from investing in stocks to exploring opportunities like Commodities Trading UK.

It’s time to start using good data to make good decisions to make good money. Get in touch and see how we can help.

Sep 18, 2024 | Accounting, Accounting Doesn't Have To Suck, Adventures In Entrepreneurship, Blog

It’s time to start making good decisions on good data.

Running a services business—whether it’s plumbing, consulting, or HVAC—requires a ton of juggling! Accounting might not be (is almost certainly not) your favorite. But having good, clean accurate info is the key to increased profitability. Here’s why:

Good Data

- Keeps You Profitable: Without accurate data, it’s hard to know if your pricing is right for the profit you want. Without clear records, you’re likely shooting blind, hoping to make money.

- Helps You with Taxes: Staying on top of your numbers means tax season will be easy for both filing and planning. Getting the right plans to your tax planning will for sure, save you money. Poor bookkeeping leads to tax mistakes and even unnecessary penalties. Using a VAT Calculator can make the process even smoother by helping you stay accurate and avoid surprises.

- Manages Cash Flow: Cash flow problems are super common in small businesses. Good, predictive cash flow forecasts help you plan for when you might (will) run low on cash.

- Saves Time: Clean financial data makes it easier to track expenses, income, and payments. No more last minute scrambling or trying to remember what happened weeks ago.

- Supports Growth: If you’re planning to grow, it’s an absolute must. The bigger the company, the bigger the mistake costs. Sort it now and fix issues before they get exponentially bigger.

Question’s Our Clients Used to Ask Themselves Before Getting Good Data (where the answer was obvious)

- Can I afford a new Truck for the Summer Season?

- Which jobs make money and which are not?

- What part of the business should I focus on to make more money?

- Are we going to be fined for anything AGAIN this year?

- Why can’t my accountant explain my books to me with me wanting to stick a fork in my eyes?

If you have felt blind or not in control of your finances, we’re here to change that!

Get in touch and we’d be happy to see how we can help.

Sign up for the FixYourProfit Dashboard and take control of your numbers—for good.

Sign up for the FixYourProfit Dashboard and take control of your numbers—for good.

Custom Chart of Accounts Mapping – See your finances the way that makes sense for your business.

Custom Chart of Accounts Mapping – See your finances the way that makes sense for your business.