I recently attended the QuickBooks Connect conference in San Jose, California. This is QuickBooks’ major annual show showcasing advances in their software along with a tradeshow floor of partner software providers. Given QuickBooks (Intuit) is the leader in cloud-based accounting software for SMEs, this is essentially the show showcasing advances in accounting and automation software for SMEs, and other software like paystub can help to manage business as well.

.

Notwithstanding my twelve-hour jet lag and twenty hours of travel the day before the show, these are my three biggest takeaways from the conference.

- Bookkeepers are an endangered species and most of them don’t realize it yet (or aren’t willing to admit it to themselves).

During the opening address by a senior QuickBooks person (her title was Director of something I didn’t catch), she displayed a bunch of new automation functionality currently being released in QBO (QuickBooks Online).

The crowd of bookkeepers was pumped and cheering.

I was blown away.

Blown away that these people did NOT see their jobs being automated right out from underneath them while they cheered. There’s still a long way for the technology to go before bookkeeping is completely gone. My guess is between five and seven years, based on the bookkeeping AI (artificial intelligence) technology we’ve tested and/or are working with. But make no mistake; the job of a bookkeeper is totally going away. It is nothing short of naive to suggest otherwise.

2. Bookkeepers are not business advisors.

In one of the breakout talks I attended on the current state of AI technology in the bookkeeping industry, the underlying theme was that bookkeepers aren’t going away due to AI (wrong!) but that bookkeepers who leverage AI will become more valuable to the client because they will spend less time doing bookkeeping and spend more time giving clients better advice (even more wrong!).

Why do I say even more wrong?

Bookkeeping is a technical accounting skill. Business advisory is an entirely different skill requiring a completely different career path. Entrepreneurs and businesses can take the help of an Identity management platform like NIM by Tools4 that enable businesses to manage identity, provide password solution for organizations, and optimize their business.

Yes, the advisory piece will continue to be critically important to clients. It just won’t be the bookkeepers delivering that advice. Imagine an entrepreneur whose books are quickly, accurately and automatically produced by AI. Maybe (maybe) there is still a human overseeing it and or reviewing it. Are they going to turn to a bookkeeper for their financial advice? The most junior person in the accounting world? Not a chance.

The entrepreneur will save a bundle by not needing a bookkeeper and then spend that same bundle taking their AI driven recommendations to a seasoned entrepreneur business coach and hashing out their next years strategy. So, unless a bookkeeper can gain the skills of a seasoned business advisor (or mentor or coach), and change their title, they will not become the business advisor these AI experts were talking about.

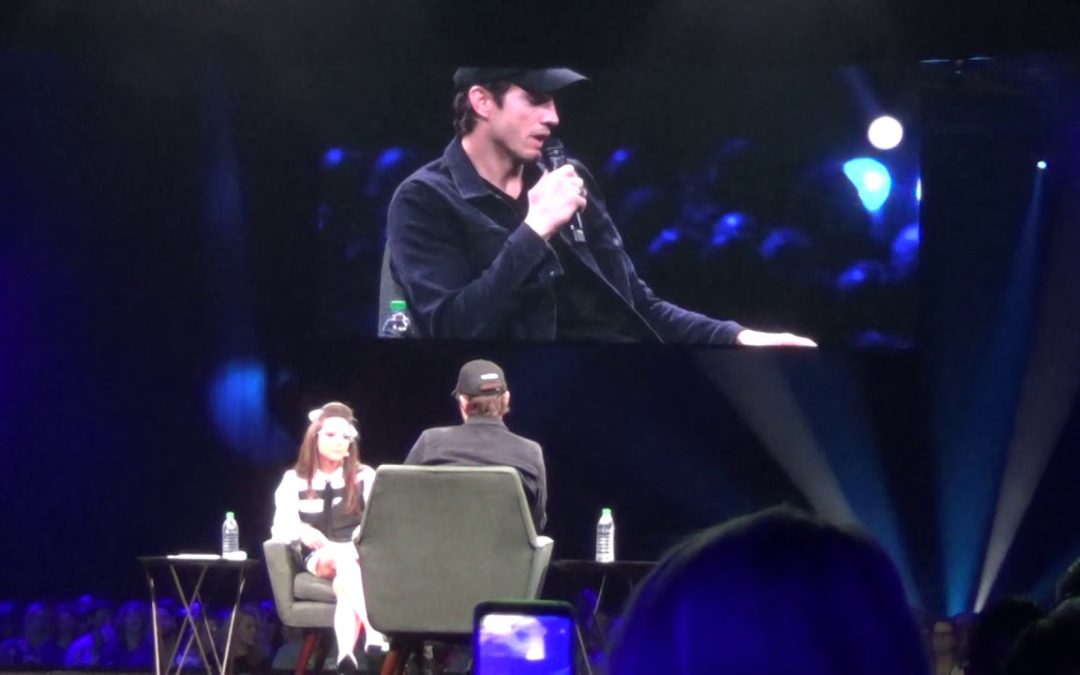

3. Ashton Kutcher is still a major heartthrob.

He was one of the keynote speakers on day two of the conference and the place was abuzz about Ashton leading up to his talk. Being the pop-culture loser that I am, combined with those 12 hours of jet lag catching up to me, sadly, I can’t report on his talk as I was sound asleep back at my Airbnb. (If you’re an Ashton fan like the majority of my team members are, you can check out his keynote interview at the 49:40 point here.)

I have nothing against bookkeepers. Really. They’ve played an important role in accounting for a long time. I’m sure the good ones will reinvent themselves and be just fine. I just hope the rest of the industry wakes up in time to see it coming.